With UCO bank mobile banking application you can transfer funds 24*7 through IMPS, NEFT and RTGS. You can transfer 50000 with imps, 2 lakh rupees through NEFT and up to 5 lakh rupees through RTGS. In this article you will get all details regarding registration for UCO bank Mobile banking in UCO Mbanking plus app.

This is what you are going to learn

UCO bank mobile banking registration process.

UCO bank mobile banking registration can be done by two types. Also read about home loan here

1. Self registration by downloading UCO mobile banking application.

2. UCO bank mobile banking registration From bank branch.

For Self registration account holder should have active ATM card and registered mobile number in account.

Download UCO Mbanking plus app from google play store.

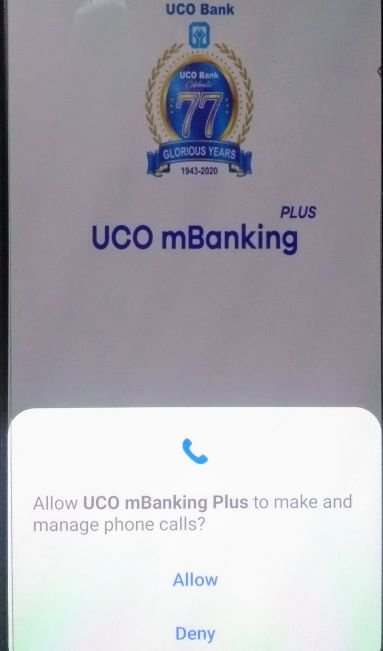

After download open application and you will come to this screen Click Allow to procced.

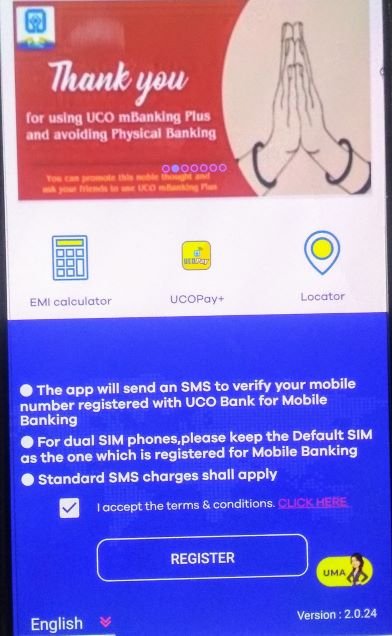

TICK mark on I accept the terms & conditions and click on register.

You will automatically come on this page now CLICK on click here to proceed.

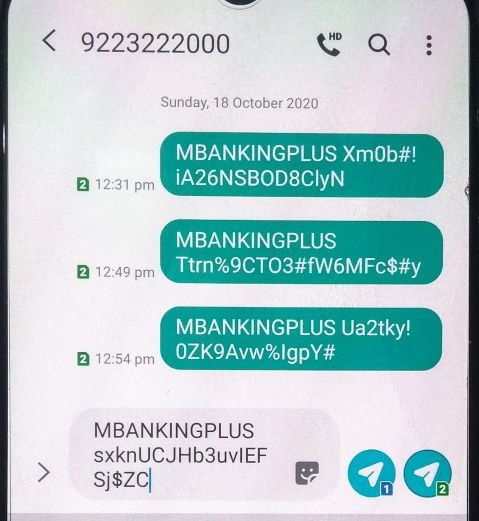

Next you will be on this screen and SEND this message from your registered mobile number i.e from SIM 1 or SIM 2. wait for few seconds.

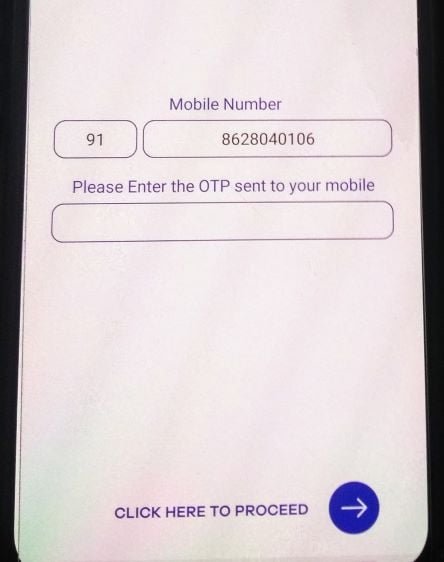

After waiting for few seconds you will be on this screen and an OTP is send on your registered mobile number. ENTER OTP and click on CLICK HERE TO PROCEED.

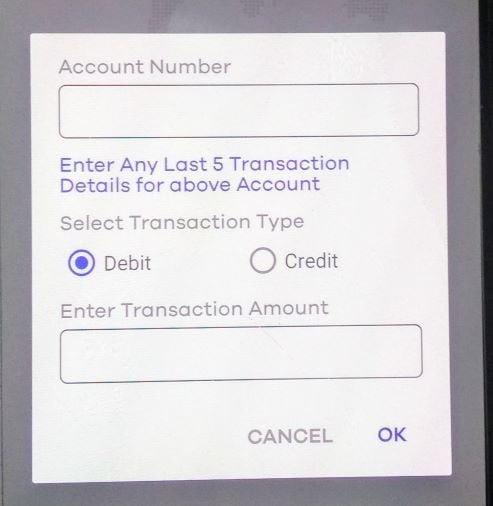

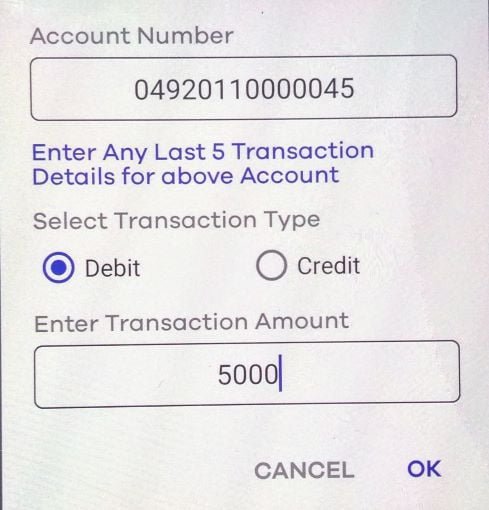

Now, enter your 14 digit account number and enter one of the last 5 debit and credit transaction in the respective fields. PRESS OK

Example for STEP 6.

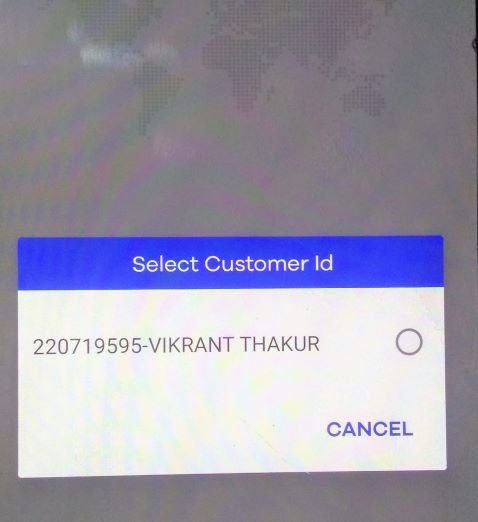

NOW your name will come on screen CLICK on it to proceed.

Now enter details of your ATM card in this screen and click on proceed.

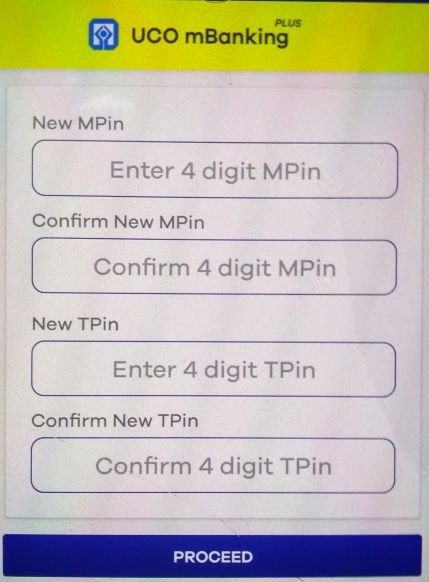

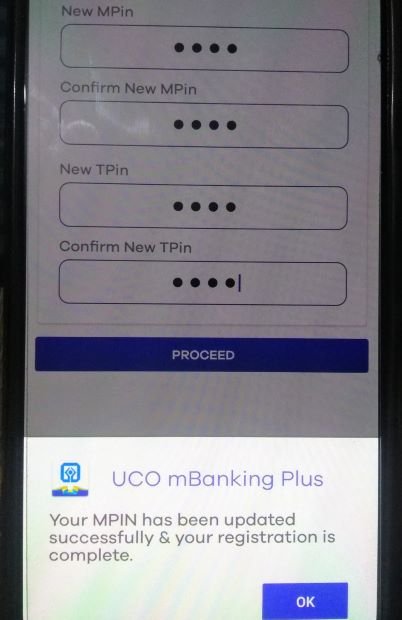

This is the final page you will visit. ENTER M PIN and T PIN of 4 digits and click on proceed.

Your registration process is Successfully completed.

How to generate or reset your ATM pin without going to bank.

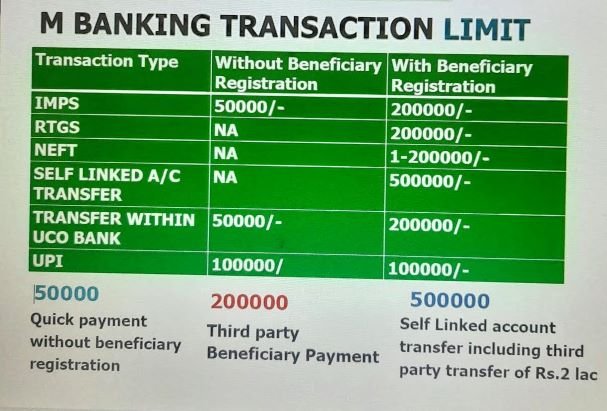

Transaction limit for fund transfer through UCO bank mobile banking

For UCO bank mobile banking registration from bank branch you have to submit application in branch and ATM card is not required in case when you are doing registration from bank branch.

HOW TO REGISTER FOR UCO BANK MOBILE BANKING

Watch vedio below for more clarification

UCO bank Mobile banking is not available to all its customers there is some eligibility criteria for UCO M banking registration.

- Account should be saving bank account operated singly or jointly under either or survivor operation.

- Current account holders can also register UCO m banking where mode of operation is sole proprietorship.

- For self registration of UCO bank mobile banking your account should be attached to mobile number.

- And also for self registration of UCO bank mobile banking customer should hold active ATM card.

- Aadhaar card of customer should be attached with the account.

- Mobile number of account holder should not be linked with multiple customer accounts.

Before doing UCO m banking registration make sure you fulfill all these requirements.

Also read :

Get quick loan for business up to 2 crore without any collateral here

For more details visit official website of UCO bank

FREQUENTLY ASKED QUESTIONS

How to register UCO mobile banking?

Go to google play store and download UCO mbanking plus app and install it on your mobile phone now do the below process:

Open UCO m banking application – Accept term and conditions and click on register – now send message from your register mobile number – Enter OTP – Enter 14 digit account number and enter one of the last 5 debit and credit transaction PRESS OK – Now select your account – now enter details of your ATM card – click on proceed – now enter MPIN twice – Enter TPIN twice – registration process complete.

What is MPIN and TPIN in UCO mobile banking?

MPIN – It is used for login into your UCO bank mobile banking application.

TPIN – It is used when you are doing any financial transaction on your UCO bank mobile application.

You can reset MPIN and TPIN as many times as you wanted to and you must keep on changing these at regular intervals as a safety measure.

Fund transfer limit in UCO mobile banking?

Transfer Without beneficiary in UCO m banking

IMPS – 50000

UPI transfer – 50000

NEFT/RTGS – not available

within UCO bank – 50000

With beneficiary in UCO m banking

IMPS – 200000

UPI transfer – 100000

NEFT/RTGS – 200000

within UCO bank 200000

UCO UPI registration?

Now through UCO m banking plus app you can transfer fund through UPI. For this the you has to enable UPI service under my profile option and set a virtual address.

Now, you can do transaction from UPI option in main menu for up to 100000 per day without adding beneficiary.

UPI not rigisterd chandra Bhan Mobile no 7351420240 ac no 06950110010662