You can get education loan up to 4 lakh rupees at only 1 to 4 percent and that to with simple interest rate under MNSSBY Bihar student credit card scheme. In this article we will discuss all the details and guidelines regarding Bihar student credit card scheme.

This is what you are going to learn

MNSSBY Bihar student credit card scheme details and guideline

Bihar student credit card yojana is launched on 2nd October 2016 in Bihar and for the students of Bihar under Mukhyamantri Nishchay Swayam Sahayata Bhaata Yojana. In this scheme low interest rate education loan is provided to domicile of bihar who passed their 12th or 10th class from Bihar board or from surrounding states like UP, Jharkhand and West Bengal. Lets discuss Bihar student credit card scheme details and guideline one by one.

MNSSBY Bihar student credit card scheme details

We will discuss objectives, benefits and eligibility criteria of Bihar student credit card yojana in this article.

Objective of MNSSBY Bihar student credit card yojana

This scheme is launched to make Youth of bihar self reliant under mission Aarthik Hal Yuwaonko Bal which is part of Mukhyamantri Nishchay Swayam Sahayata Bhata Yojana and is one of the 7 nishchay(mission) which government of bihar marked important under Bihar Vikas Mission.

- By allowing low interest rate education loan improvement will be seen in the gross enrollment ratio for higher education.

- One of the major objective of this scheme is to provide and create better opportunities for higher education to all the youth of Bihar. This will provide equal opportunity for all the students and no one will left out from getting higher education irrespective of their financial condition.

- Empowering women by allowing concessional interest rate on loan to female.

- In order to reduce disadvantages faced by disabled person Concessional interest rate on loan given to disabled persons. This will provide fair opportunity for higher education to all.

- Making life better for transgenders by providing equal opportunity for getting higher education with concessional interest rates on education loan.

| Interest rate on MNSSBY Bihar student credit card scheme is 4% simple interest. For females, disabled and transgenders interest rate is only 1 % simple interest. |

MNSSBY Bihar student credit card benefits

Below are the list of all the benefits of bihar student credit card yojana:

- Maximum Loan of rupees four lakh is provided under this scheme for higher educations.

- Bihar student credit card loan interest rate is 4 percent at simple interest .

- Bihar student credit card loan interest rate for female, disabled and transgender is only 1 percent at simple interest.

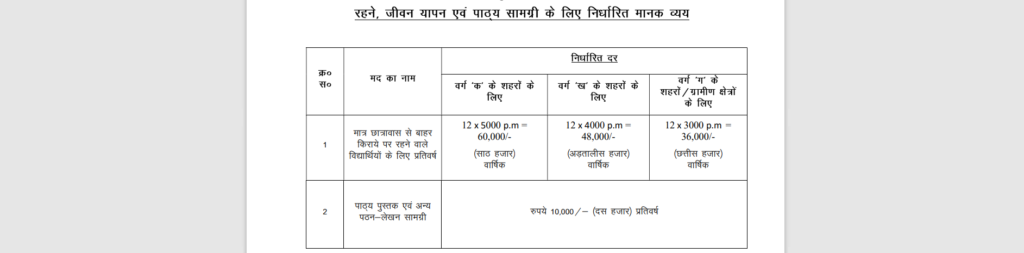

- Loan is provided for academic tuition fees, hostel fees and yearly expenses for books etc.

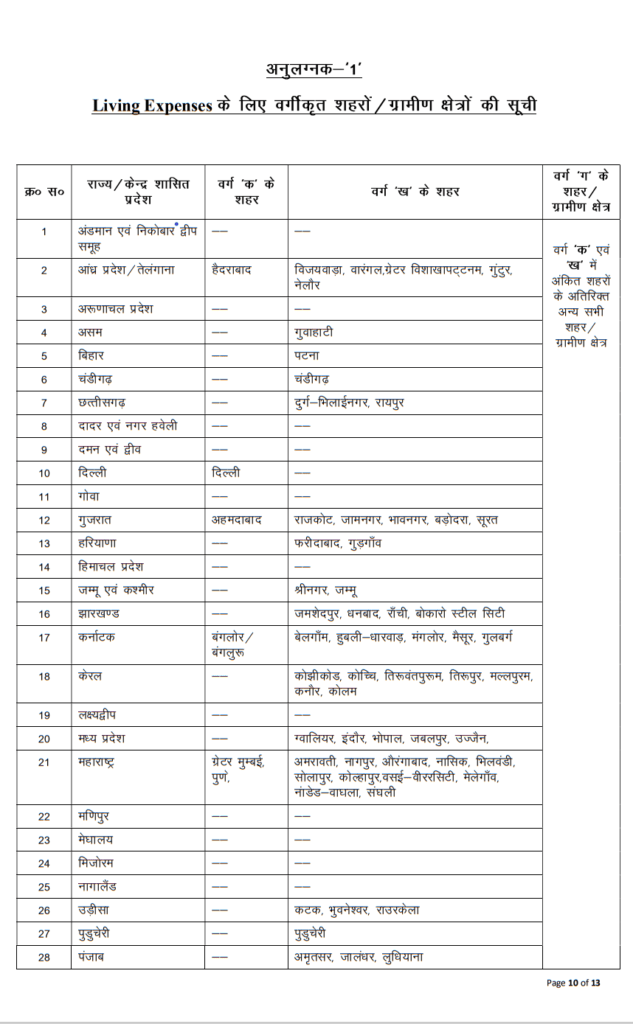

- If not staying in hostel then rent as per area categorization will be paid.

- Ten thousand rupees per year are given for purchases of books.

- For loan amount up to Two lakh rupees repayment period is 60 months (5 years) and for amount more than four lakh rupees repayment period is 84 months(7 years).

- Moratorium given under this scheme is 1 year after completion of course or 6 months after getting job which ever is earlier. ( moratorium means time period for which no instalment is paid you have to start repaying your loan amount after moratorium period)

- In case applicant is not able to get any job even under swarozgar yojana then moratorium period may be restructured as per situation.

- If applicant have paid loan amount within time frame then concession of .25 percent on interest rate will be given.

- if applicant do not pay loan amount willfully than action under PDR act (Public Demand Recovery Act) will be initiated.

MNSSBY Bihar student credit card scheme guidelines

Under guidelines we will discuss eligibility criteria and documents required for taking loan under MNSSBY Bihar student credit card scheme.

MNSSBY Bihar student credit card eligibility criteria

Below are the eligibility points for this scheme:

- Applicant should have been admitted or selected for higher education for which he/she is applying for loan.

- Applicant should be domicile of Bihar.

- Applicant should have passed 12th exam from Bihar or surrounding states ( UP, Jharkhand and West Bengal)

- Applicant should have passed 10th exam( for polytechnic admission) from Bihar or surrounding states ( UP, Jharkhand and West Bengal)

- Loan is given for higher education after 12th and for polytechnic courses after 10th.

- Applicant should be less than 25 years of age at the time of submitting application and for courses where minimum qualification required is graduation then age limit is 30 years.

Documents required for MNSSBY Bihar student credit card scheme

Below is the list of documents required for Bihar student credit card yojana:

- Copy of Aadhaar card of applicant and co-applicant.

- Marksheet of matriculation i.e. 10th and intermediate i.e. 12th class.

- Proof of admission or selection.

- Two photographs of each applicant and co-applicant.

- Income certificate of father.

- Last two years ITR (Income tax return )

- Bank statement of last six months.

- Address proof like Aadhaar card, driving license, voter card, passport etc.)

- Pan card number is mandatory for applicant and co-applicant

- Duly filled Common application form for MNSSBY Bihar student credit card scheme.

Also read : Pradhan mantri kisan samman nidhi yojana complete details

Sovereign Gold Bond Scheme 2021 | SGB

Pradhan mantri vaya vandana yojana | PMVVY scheme details

Official website for more details

Frequently Asked Question on MNSSBY Bihar student credit card scheme

#1. Who can get Bihar student credit card?

For getting loan under Bihar student credit card scheme below are the mandatory points:

1. This scheme is for Domicile of Bihar only.

2. You should have done 12th from Bihar board or from surrounding states like UP, WB and Jharkhand.

3. Your age should be below 25 year for courses require 12th as minimum qualification.

4. Your age should be below 30 year for courses require graduation as minimum qualification.

Above are the basic requirement for getting education loan under Bihar student credit card yojana.

#2. Bihar student credit card loan interest rate?

Education loan under this scheme is provided at lowest possible interest rates. Below are the rates applicable under this scheme:

1- 4 percent at simple interest (3.75 percent if repaid within stipulated time frame)

2- 1 percent at simple interest for females, disabled and transgenders.

#3. Repayment period for Bihar student credit card loan?

Repayment period is different for different amount see details below:

1. For loan amount Up to 2 lakh rupees repayment period is 60 months.

2. For loan amount above 2 lakhs repayment period is 84 months.

#4. Moratorium period in MNSSBY Bihar student credit card scheme?

Moratorium period in this loan is one year after completion of course or 6 months after getting job which ever is earlier.

And if somehow applicant is not able to get job or is unable to repay loan amount restructuring of loan period and moratorium can be done.

.

Leave a Reply