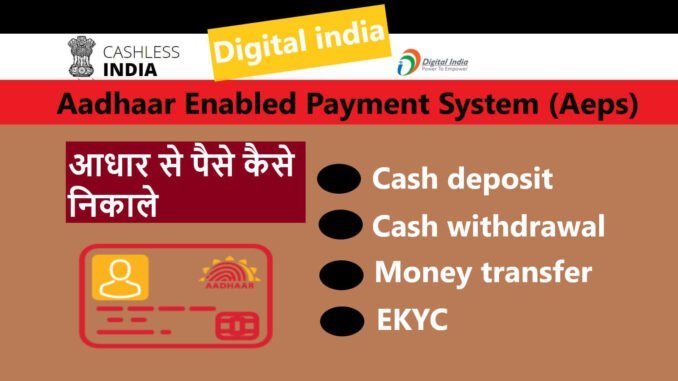

AEPS is a Aadhaar enabled payment system which enable user to do various banking transactions with Aadhaar card. Aeps service is covered under digital India programme which is one of the flagship programme of Indian government. It is a bank led progaramme through which various banking transactions like cash withdrawal, cash deposit, cash transfer etc. are done paperless. In this article we will discuss all the details of Aadhaar Enabled Payment System.

This is what you are going to learn

Aadhaar Enabled Payment System explained | AEPS service

It is a bank lead programme under which banks depute or appoints Business correspondents/ Bank Mitra at various locations. These appointed Business correspondents will perform various banking transactions like cash withdrawal, cash deposit, cash transfer, online EKYC verification etc by using Aadhaar card authentication.

Service’s offered by Aadhaar Enabled Payment System (AEPS service)

There are various services offered under this system and different bank offer different service but there are some standard services which bank have to make available as per govt. guide lines at there Service center/business correspondent points.

- You can enquire your account balance at these service centers.

- You can make cash withdrawal by using Aadhaar authentication(usually not more than ten thousand rupees)

- You can deposit cash by using Aadhaar authentication(usually not more than ten thousand rupees)

- You can transfer money from one account to another at these service centers/business correspondent points.

- You can also perform EKYC verification i.e. online verification of your Aadhaar card authenticity.

- Aadhaar seeding status can also be updated at these Service center/business correspondent points.

| 1.At some Service center/business correspondent points you can also open basic small saving account with Aadhaar card as Address and photo proof. 2. Cash deposit and cash withdrawal limits are set by individual banks so, there may be different limits for different banks. |

What customer is required to have for making use of AEPS service.

Any customer of any bank can make use of Aadhaar Enabled Payment System (AEPS service) for doing certain transaction. Customer only need to produce below documents at Service center/business correspondent.

- Aadhaar number/ Aadhaar card.

- Bank name in which you have your account.

- customer is required to give biometric authentication before doing any type of transaction.

| Note – For doing any transaction at these service centers/business correspondent your Aadhaar number must be attached to your bank account number and bank account should not be dormant it should be in Active state. |

Objective of AEPS service.

- To encourage Bank account holders to use Aadhaar card in their accounts. So, that they can perform basic banking services from Business correspondent center near there location.

- With introduction of this service rural population will be included into banking system under financial inclusion.

- To make paperless, cashless transactions and to introduce rural population with digital banking.

Benefits of using Service’s offered by Aadhaar Enabled Payment System (AEPS service)

- Seamless financial transaction with only Aadhaar and biometric authentication.

- This payment system is Easy to use as it only require your Aadhaar card number and your finger print

- Threat of fraud happening is less with AEPS transactions.

- Government distribute all its subsidies through Aadhaar enabled system.

- People can withdraw money from near by service center which will save their time and money both.

Also read :

Gold loan at 4 percent interest rate

Pradhan mantri kisan samman nidhi yojana complete details

Read more at official website of NPCI

Frequently asked Questions

#1. Full form of AEPS?

AEPS stand for Aadhaar enabled payment system. In this system you can do various banking transaction with your Aadhaar card and biometric authentication. Service offered at these centers are cash deposit, cash withdrawal, money transfer etc. This system of doing banking transaction is authentic and very safe to use as without your biometric impression no transaction is done.

#2. How to use AEPS service?

To avail or make use of services provided at these centers visit near by service center or any authorized Bank business correspondent with your Aadhaar card number. You have to give your Aadhaar number – Bank name with which you have your account – Your biometric authentication for final transaction to happen.

Note – For doing any transaction at these service centers/business correspondent your Aadhaar must be attached to your bank account number.

#3. Where to lodge complaint if transaction failed?

If there is any dispute regarding any cash transaction then customer can contact bank branch and submit complaint. All transaction done at these service points are easily traceable.

thanks for the gret content sir. i will Aslo share with my friends & familys once again thanks a lot

thanks a lot keep sharing