You have to submit your 15g form in bank in the month of April in order to avoid tax deduction on source i.e. TDS deduction. From here you can download and check sample of completely filled 15g form.

This is what you are going to learn

15g form fill up sample | Download form 15G from below

From below sample you can check how to fill your form 15g without asking bank employee for help. From below sample you will be able to fill your 15 g form completely without any mistake and error.

See below image for filling 15g form

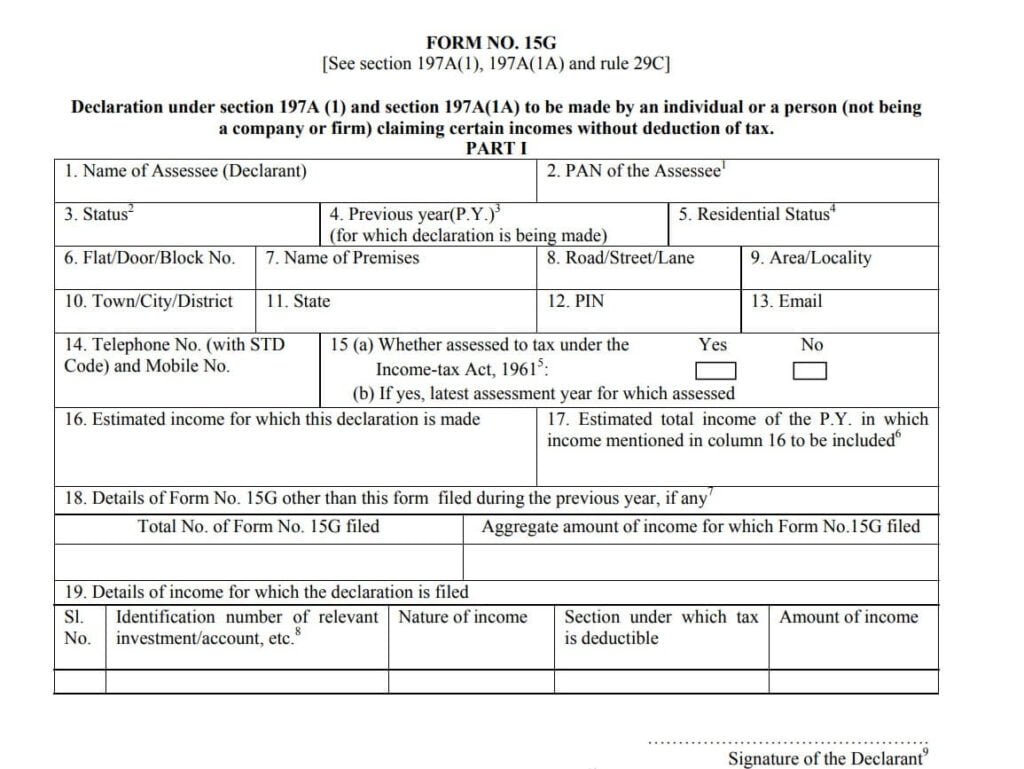

Below is a sample of how form 15 G is like you can check image below this image for filling 15 G form.

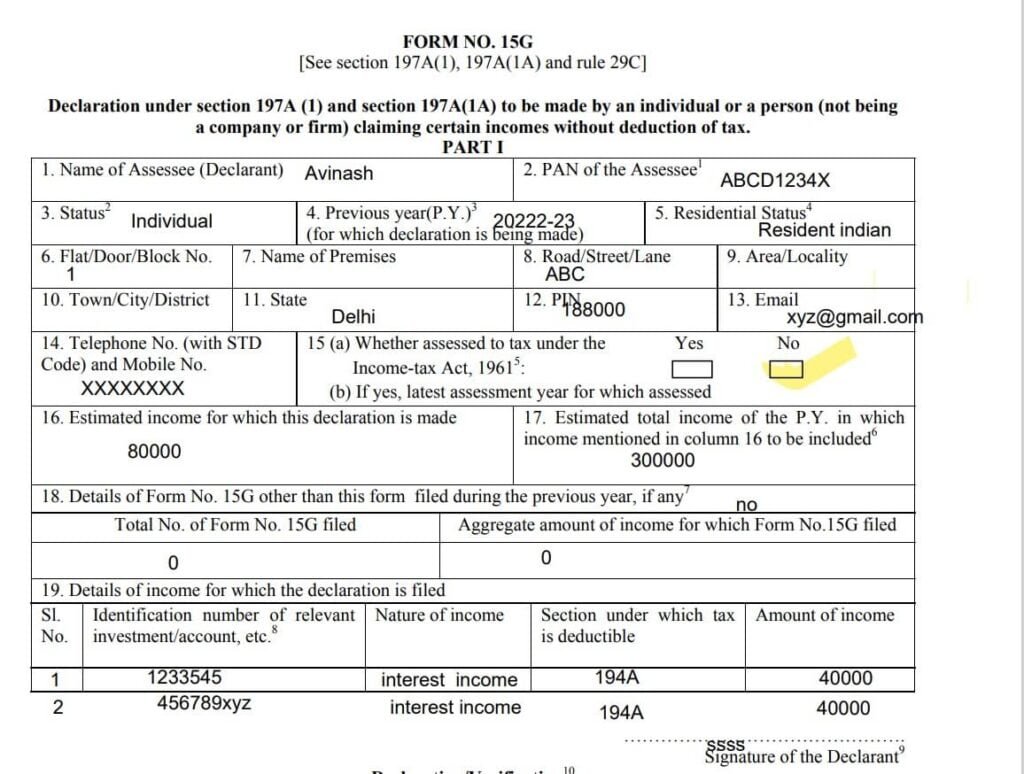

Below is a filled image of form 15 g you can check and fill you form 15G as per you applicable details.

Point by point explanation of details to be required for 15g form fill up

- Name of Assessee (Declarant) – here you have to enter your name i.e. name of the apllicant or account holder for which you are submitting form 15 G

- PAN of the Assessee – Here you have to enter pan number of the applicant or account holder for which you are submitting form 15 G

- Status – Here you have to enter Resident individual

- Previous year(P.Y.) – Here enter perivious year for which you have submitted form 15 G

(for which declaration is being made) - Residential Status – Here you have to enter your resident status i.e. Indian

- Flat/Door/Block No. – Here enter your residential addres

- Name of Premises

- Road/Street/Lane

- Area/Locality

- Town/City/District – district from where you belong

- State – state from where you belong

- PIN – pin code of the area from where you belong

- Email – your email address if have any

- Telephone No. (with STD

Code) and Mobile No. – enter you telphone or mobile number - (a) Whether assessed to tax under the Yes No

Income-tax Act, 19615

:

(b) If yes, latest assessment year for which assessed - Estimated income for which this declaration is made 17. Estimated total income of the P.Y. in which

income mentioned in column 16 to be included6 - Details of Form No. 15G other than this form filed during the previous year, if any7

Total No. of Form No. 15G filed Aggregate amount of income for which Form No.15G filed - Details of income for which the declaration is filed – here you have to add all your account number for which you are submitting form 15 G

Sl. – here enter account numbers for which form 15 G is submitting

No.

Identification number of relevant

investment/account, etc.8

Nature of income Section under which tax

is deductible

Amount of income – estimated and aggregated amount of income for which form 15 G is submitting

From below lin you can download form 15g

You can check our other useful links also :

Watch our vedio on YouTube regarding15g form fill up process.

other useful link are below :

Bihar stident credit card scheme

Visit UCO bank website for Online loan applications

Frequently asked question on Form 15g fill up process :

Last date for submitting 15g form in banks?

Form 15 g is submitted in order to avoid deduction of TDS i.e. tax deduction at source. Means as per government rules if any one is getting interest on saving more than forty thousand for general citizens and fifty thousand for senior citizens you can submit form 15 G to avoid tax deduction at source. So to avoid this deduction it is suggested to submit form 15 g in the month of April other wise your TDS will be deducted.

Hope this will help you to get your answer.

what happens if form15 G is not submitted?

if you do not submit form 15 g then on interest earned on your saving will attract TDS deduction. And to claim this you have to fill income tax return at the end of financial year or dates declared by income tx department.

Leave a Reply