You can register for union bank mobile banking from union bank mobile application U-Mobile or from any union bank’s ATM’s or by visiting branch or from official website of union bank. All customer of union bank having saving account, current account and OD account with valid and working debit card can avail union bank mobile banking service.

This is what you are going to learn

Union bank mobile banking registration.

Union bank mobile banking registration from U-Mobile application

Watch vedio for online money transfer in union bank mobile application

For Union bank mobile banking registration you have to download U-Mobile application from your mobile’s play store or you can give a missed call to 09223060000 form your registered mobile number to get a link for mobile download.

Go to google play store or apple play store and search for U-Mobile – union bank of India mobile banking application. Download and install it on your mobile phone.

After downloading the U-mobile application open it and you will see this screen now click on Allow to move forward for UBI mobile banking registration.

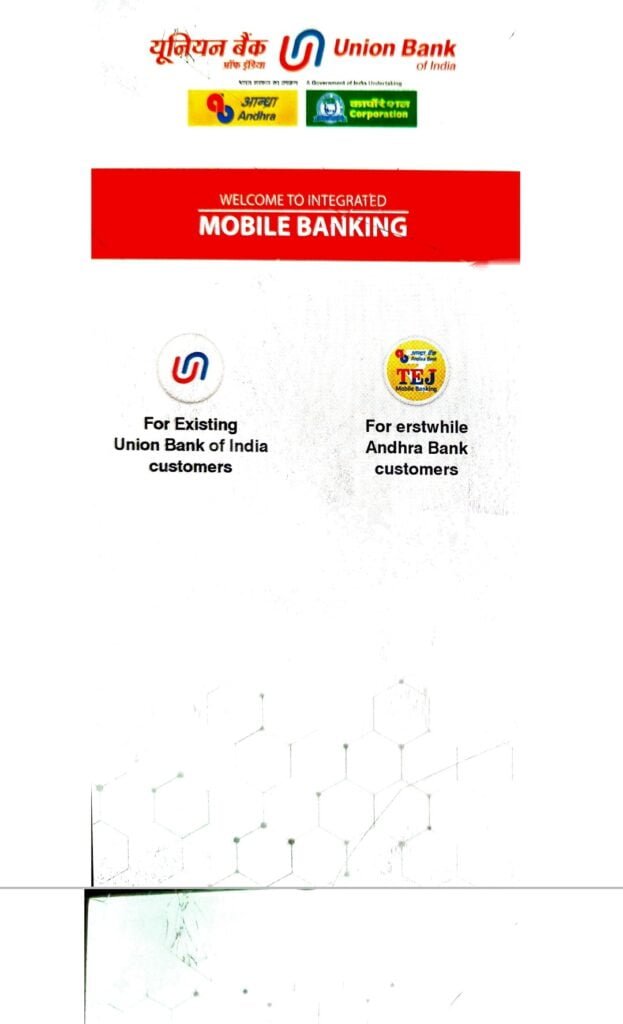

Now, click on the link for Existing union bank of India customer and proceed to next window.

Select language and proceed to next window.

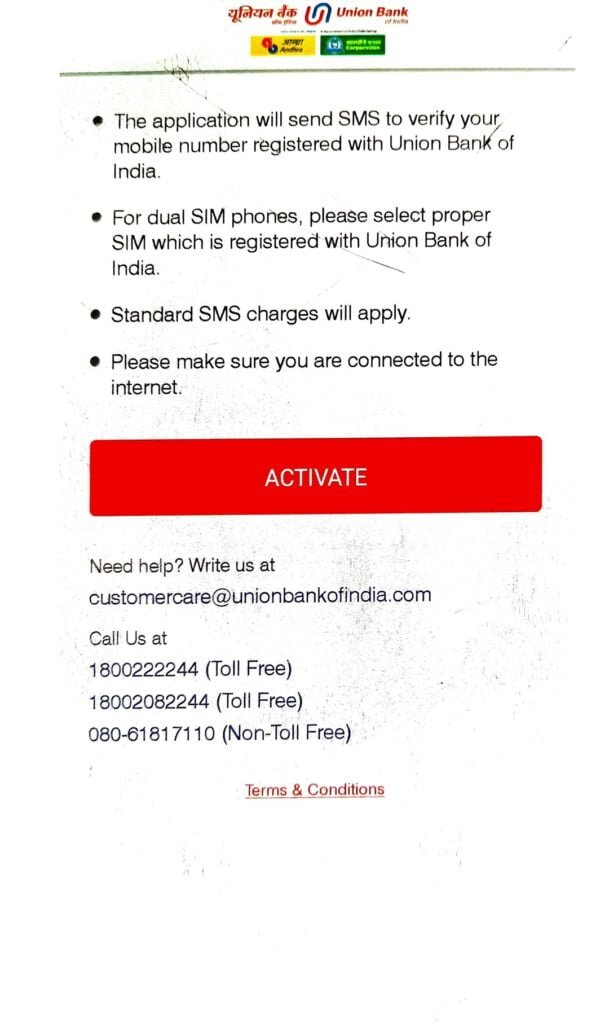

You will be on this screen now, click on activate

Click on allow to proceed to next screen.

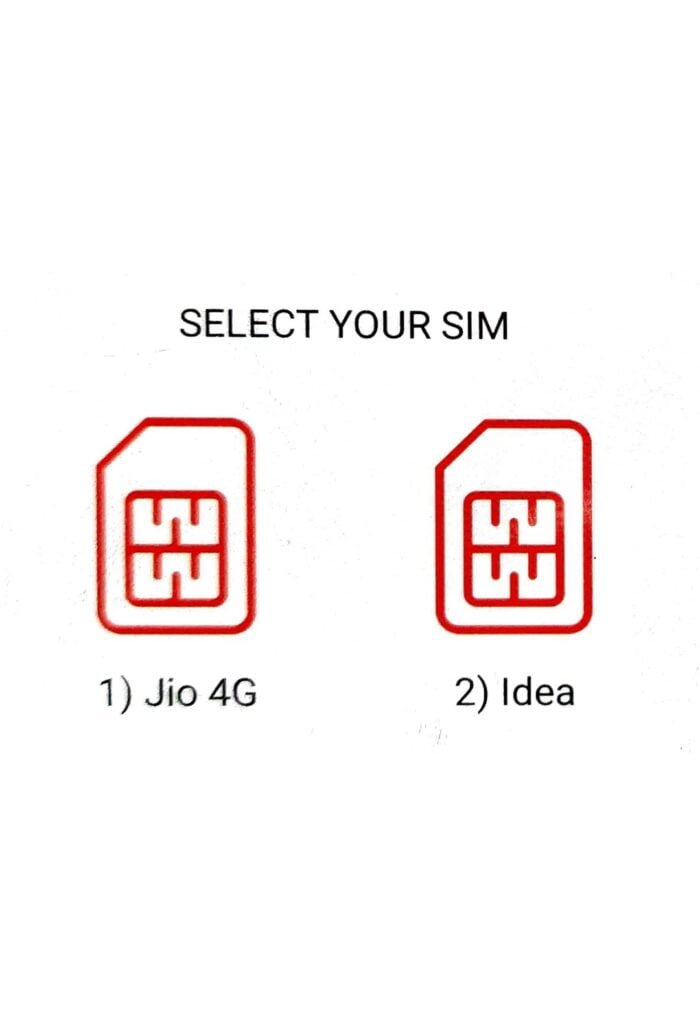

Now, select sim which is registered with your union bank account number. As application will send SMS to verify your mobile number so, if you have dual sim mobile than choose your registered mobile sim properly.

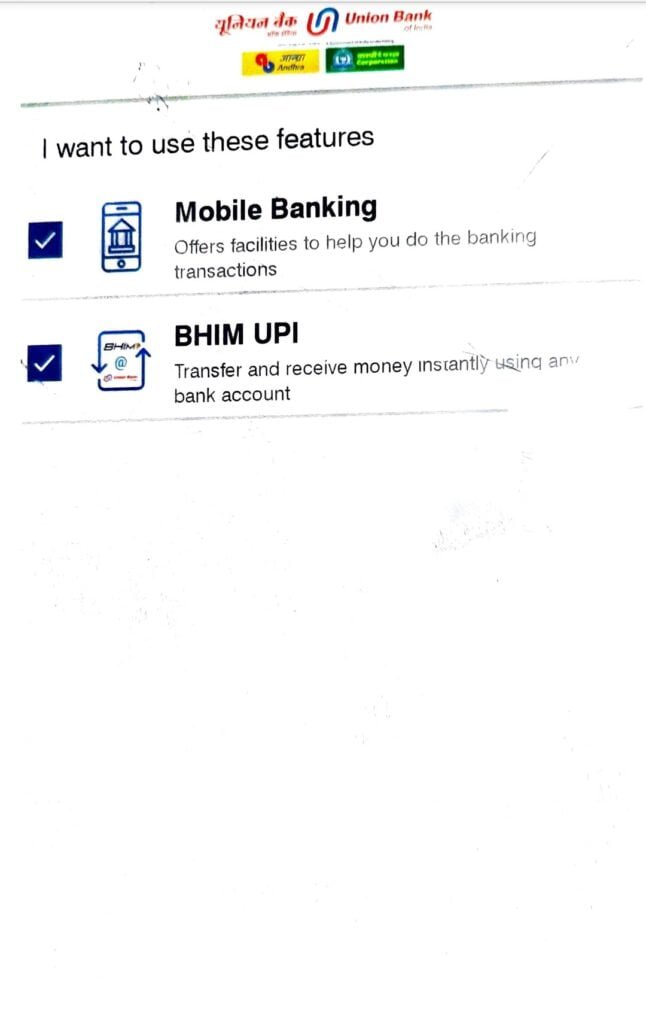

With U-Mobile application of union bank you can use Mobile banking service and BHIM UPI. So, tick mark on both the options and click on proceed to go on next screen.

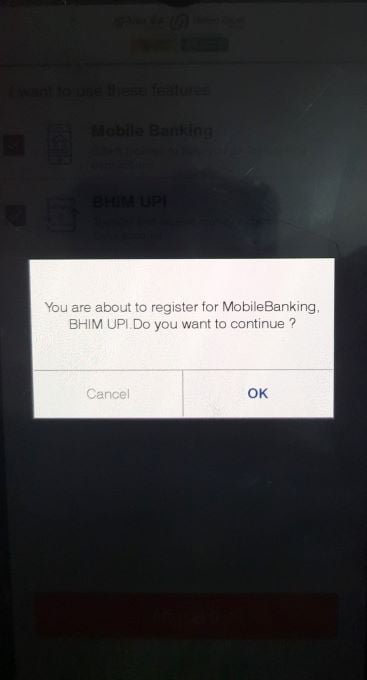

click OK.

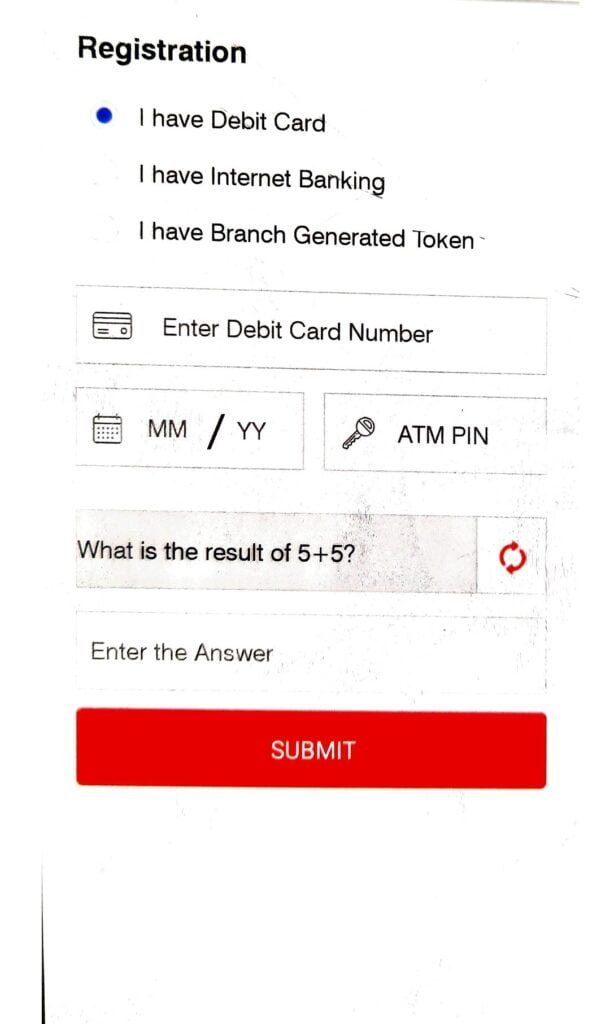

Select one out off three options, if you have ATM Debit card then select I have debit card and enter debit cards details. Click on submit

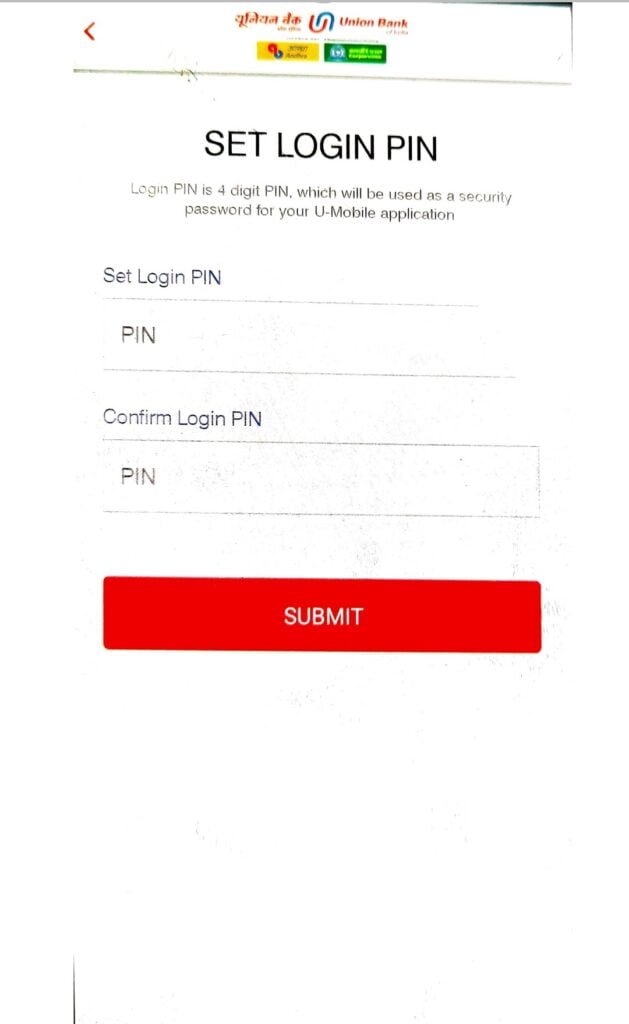

Now, enter any four digit login pin of your own choice and confirm that number. Click on submit.

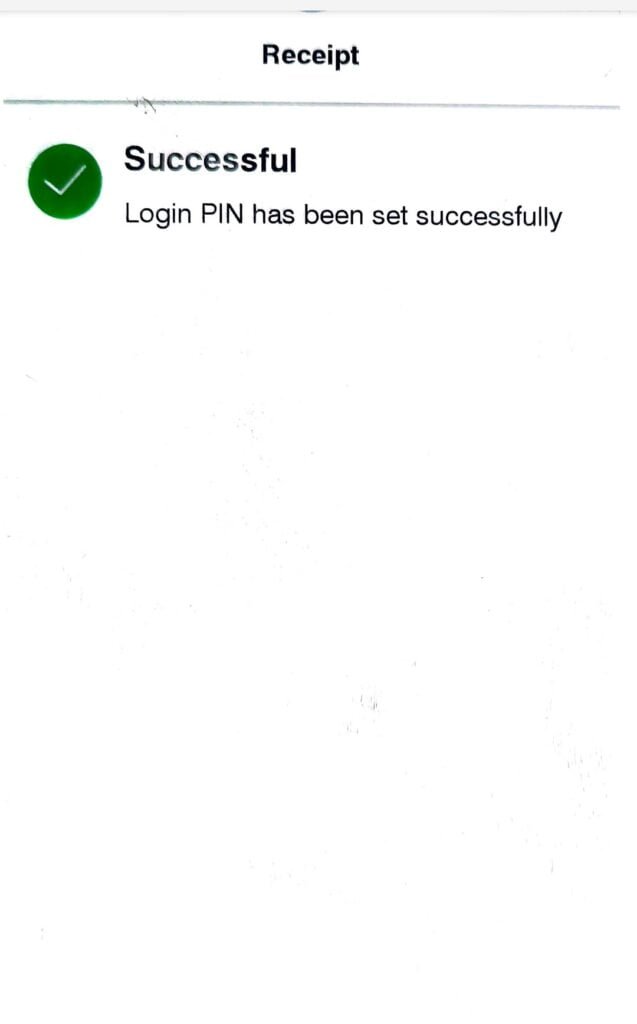

You have successfully created login pin for using U-mobile application.

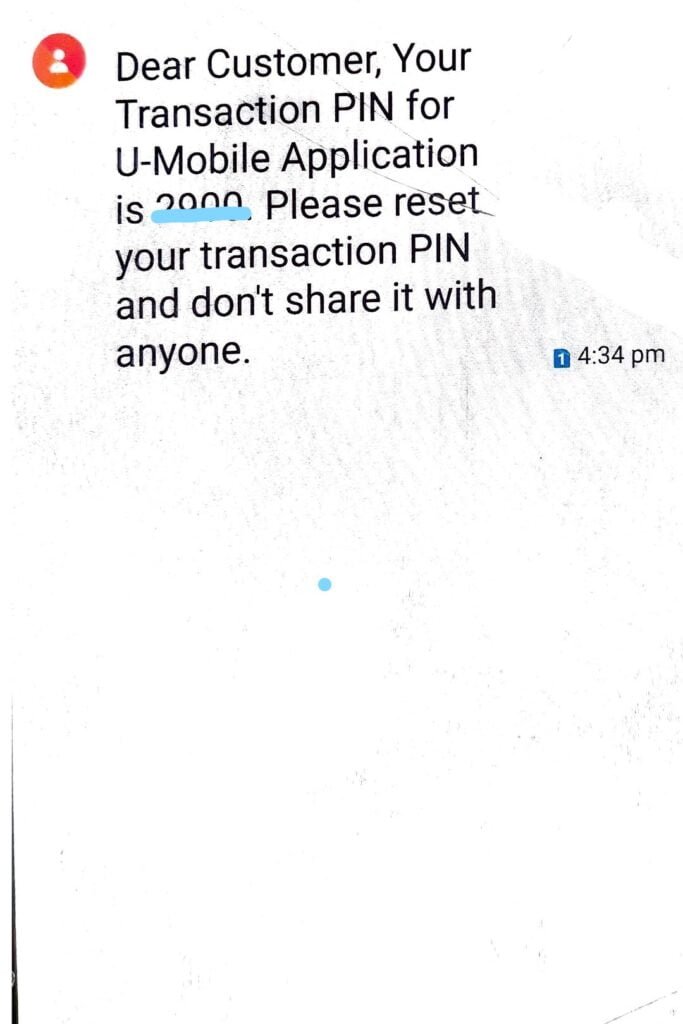

After setting login pin You have to set transaction pin for money transfer. You will get this message after setting login pin.

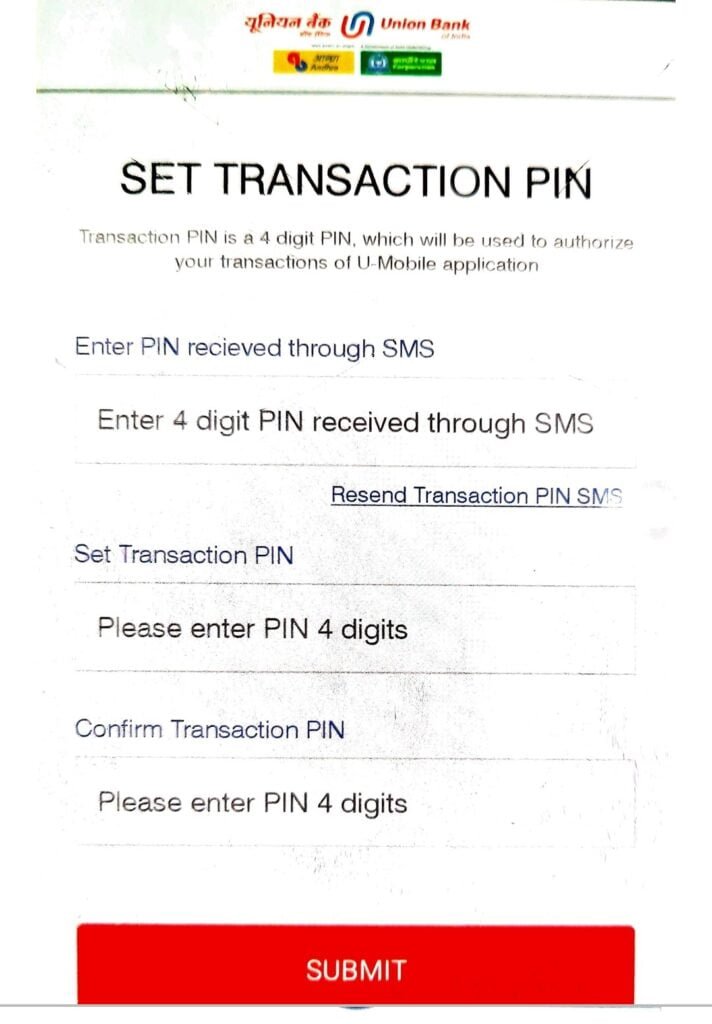

Now you have to set transaction pin. Enter four digit OTP pin send on your mobile number and set four digit transaction pin of your choice. Transaction pin and login pin should be different.

You have successfully created Your U-mobile login and transaction pin

Transaction limit for fund transfer from Union bank mobile banking app.

You can transfer maximum of rupees two lakh using U-Mobile union bank mobile banking application.

Union bank mobile banking registration is not available to all its customers there is some eligibility criteria for U-Mobile registration.

- Account should be SB/CD/OD account operated singly or jointly under either or survivor operation.

- Current account holders can also register Union bank m banking where mode of operation is sole proprietorship.

- For self registration of union bank mobile banking registration through U-mobile application your account should be attached to mobile number.

- And also for self registration of union bank mobile banking customer should hold active ATM card.

- Aadhaar card of customer should be attached with the account.

- Mobile number of account holder should not be linked with multiple accounts.

For more details: Visit union bank official website

How to register Union bank mobile banking?

Go to google play store and download U-Mobile application of union bank or you can give a missed call to 09223060000 form your registered mobile number to get a link for mobile download. Install it on your mobile phone now do the below process

Open U-Mobile app – click on Allow – click on Existing union bank of India customer – Select language and proceed – click on activate – Click on allow – select sim which is registered with your union bank account number – Tick mark Mobile banking service and BHIM UPI and click proceed – select I have debit card and enter debit cards details – Click on submit– four digit login pin of your own choice – After setting login pin You have to set transaction pin – Enter four digit OTP pin send on your mobile number – set four digit transaction pin of your choice – You have successfully created login and transaction pin. Union bank mobile banking registration successfully completed.

Fund transfer limit in Union bank mobile banking?

You can transfer maximum of rupees two lakh using U-Mobile and 5000 using SMS banking.

What does login pin means?

It is a four digit pin required to open your mobile banking application. Without login pin you are not able to login or you can not complete union bank mobile banking registration.

What does transaction pin means?

It is also a four digit pin which you have to set on your banks mobile banking application. It is different from login pin

Transaction pin is required to transfer money from your account without setting login and transaction pin union bank mobile banking registration process is not complete.

Services offer by union bank mobile banking application U-mobile?

Union bank mobile banking registration have following benefit.

U-mobile service of union bank has the following features

1- Balance enquiry

2- Fund transfer ( neft/rtgs/imps)

3- Mini statement

4- KVS fee payments

5- Debit card hotlist

6- ATM/Branch locator

7- Mobile recharge

8- Cheque book request

9- Stop cheque payments

There are many more services which you will get in U-mobile application after Union bank mobile banking registration is completed.

Leave a Reply